On this page

- In-Between Travel payments for employees

- Payment per average travel distance

- Calculating average travel times

- How the IBT system works out payments

- Exceptional travel

- If you disagree with your payment

- If your payments are less than you received before IBT

- Keeping a travel log

- Future changes to IBT

- Example 1 – Standard Travel

- Example 2 – Round Trip Exceptional Travel

- Example 3 - Standard Travel and Exceptional Travel

In-Between Travel payments for employees

The IBT Agreement sets out how employees will be compensated for travel spent between seeing clients.

The legislation sets out the detail needed to put that into effect — including the:

- mileage rate

- qualifying distance

- qualifying time, and

- maximum travel distance.

IBT includes payment for travel time, distance and Exceptional Travel.

Payment per average travel distance

The payment is based on average travel distance across the sector, not actual travel distance.

The average distance travelled by support staff is 3.7km. This is multiplied by the approved mileage rate per km.

The current approved payment is $.635 (63.5 cents) per kilometre.

The distance payment is reimbursement and therefore not taxable. Travel to the first visit is not included.

Calculating average travel times

The average travel time for support workers is calculated at 8.5 minutes. The travel time includes an allowance for time from your car to the door of the client’s home.

How average times were calculated

Data was collated for support worker actual travel time and distances.

This data showed that the majority of support worker visits were less than 5 km. Based on the information provided, the parties agreed on a one band model based on average journeys, that was simple and easy to administer. The calculations are based on averages that are specified in the legislation.

There is an amount built into the ‘time’ payment to allow for circumstances such as travel during peak traffic, poor roads, the time it takes to find a park and time taken to get from my car to the client’s door.

How the IBT system works out payments

The legislation and guidance to your employer sets out how to work out payments according to time and distance.

The payments compensate for travel time and costs between clients. Your normal hourly rate is paid for time with clients which does not currently include hourly payments for travel costs.

For example, if you providing care for 1 client for 2 hours you do not get paid for the second hour if it's continuous with the first hour and doesn’t require a second separate visit.

The travel payments replace any travel allowance that has been paid previously.

If you visit the same client twice in one day

You will be paid for both visits as long as it is not the first client of the day (except when the first client of the day is an ACC client), and each visit is logged as an appointment in your roster.

Payments for visiting clients who receive ACC support

ACC, while not a party to the IBT settlement, agreed to enter into similar arrangements in respect of the home and community-based support services that it funds.

Payment under ACC will be paid in the same way as IBT funding. ACC will continue to fund for first visits each day.

Reimbursement for walking, bussing or biking

You will be paid in the same way as everyone else. For exceptional travel you will be paid as if you were driving in-between clients.

Exceptional travel

Under IBT, Exceptional travel is paid when:

- you are required to travel a distance more than 15 km one way to a client

- there is no other employee available who can meet the specific needs for the client

You will be paid for the actual distance and time spent travelling. This applies to:

- first visits each day

- travel home from last visit each day

- in-between clients throughout the day.

The IBT settlement specifies the band for distance travelled and a mileage payment. Exceptional travel is paid after the banded range has been exceeded.

If you disagree with your payment

You should speak to your employer in the first instance. If you need to take matters further, you can use the dispute resolution provisions of the Employment Relations Act. You may wish to seek union, or other employment relations, advice at this point.

If your payments are less than you received before IBT

The legislation states that no employee employed before the Interim Solution that started on 1 July 2015 will be financially disadvantaged by the change to the payment system.

If your entitlement for travel time and costs is less overall under the new system than it was prior to the interim solution, you will be compensated to make sure you are not disadvantaged.

Keeping a travel log

You only need to keep a travel log for trips that are for exceptional travel and if your employer doesn’t have systems to collect the time and distance for these trips. Even a travel log isn't required, it may be useful to keep one initially.

Future changes to IBT

There may be adjustments to IBT once it is in full operation in the sector.

For that reason, there will be ongoing engagement with the settlement parties and other key interested groups and our guidance will be updated where appropriate.

The legislation provides for an annual review of the IBT schedule of payments.

Monitoring issues

A monitoring group has been set up with representatives from Unions, Providers, Health New Zealand, ACC and the Ministry to look at a range of issues going forward, including increasing the minimum mileage rates, the impact the wage increases have had, and financial disadvantage for support workers.

Payment examples

The following examples have been calculated using band level 0

Example 1 – Standard Travel

A car leaves home and travels: 4km to Client A unpaid (ACC will pay for first visit), 10km to Client B paid $5.66, 5km to Client C paid $5.66, and 3km home unpaid.

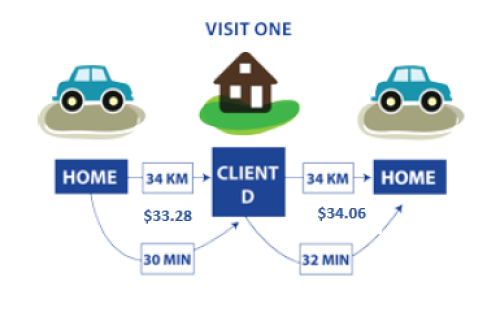

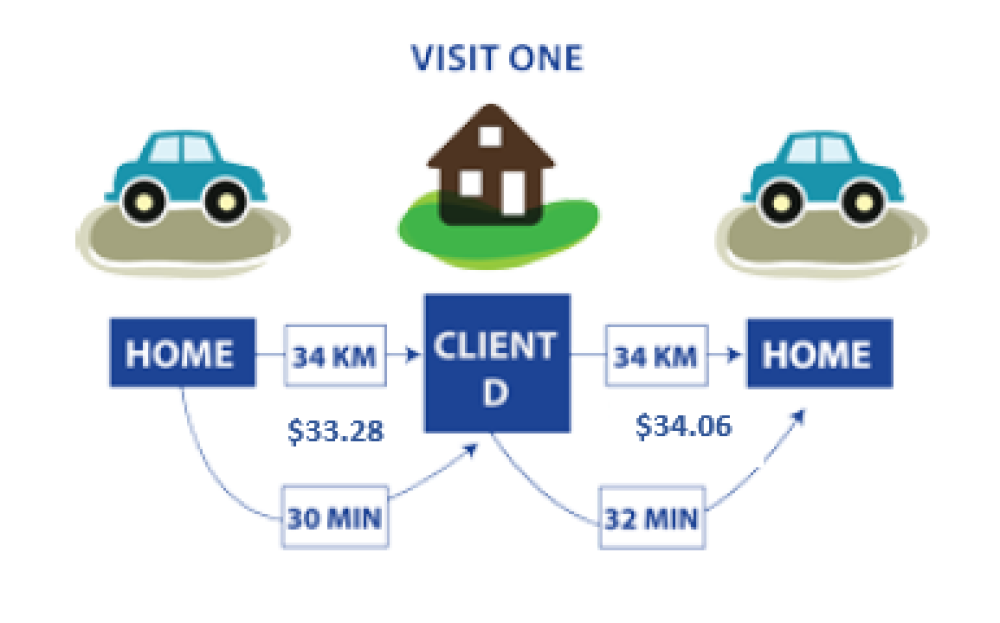

Example 2 – Round Trip Exceptional Travel

A car leaves home and visiting 1 client. It travels: 34km to Client D for 30 minutes and is paid $33.28, then travels 34km home for 32 minutes and is paid $34.06.

Example 3 - Standard Travel and Exceptional Travel

A car makes 3 visits. It travels 4km to Client E unpaid (ACC will pay for first visit), 16km to Client F for 30 minutes and paid $21.85, 5km to Client G paid $5.66, and 21km home for 25 minutes paid $23.08.